What is the technology sector?

The development, research, and distribution of products and services in electronics, software, computers, and AI (Artificial Intelligence: Do you know that the early 2024 stock market rally can be linked to enterprise AI adoption).

Why invest in the technology sector?

The sector is one of the most attractive for growth-oriented investors. Sectors like finance, industrial, and retail heavily rely on technology to increase efficiency, productivity, and profits. Tech firms offer both consumers and business goods and services. Consumer goods such as personal computers, mobile devices, wearable, and television, for business tech include enterprise software, database, and networking security.

What are the major sectors within technology?

Majorly the technology sector can be divided into Semiconductor, software, hardware, and networking. While not all tech firms fit into one of these categories, the majority do, and it is a useful way to talk about the sector as a whole.

Software Sector

What is a Software?

Software is a set of instruction, data, or program to operate computers or execute defined tasks on devices, such as Operating systems, MacOS, Google Chrome, Excel, etc. Small startups spring up virtually overnight to disrupt a market leader as the entry barrier may be low. Though support and reputation are key aspects of a business choosing to work with a software provider, this is still a fertile land for new products and services.

Semiconductor Sector

What is the semiconductor sector?

Semiconductor sector is an aggregate of businesses that engage in production, design, or marketing of devices, integrated chips, or circuits made of special metals. Such products may be used in smartphones, cars, and medical devices. These products use a component that conducts and blocks electricity under certain conditions.

During the COVID-19 pandemic, the semiconductor shortage caused massive delays in production. The Auto Industry was particularly affected, causing revenue disruptions of billions of dollars. (What caused the semiconductor shortage?) Factors like the semiconductor sector running at capacity, spike in demand for personal electronics, and 5G rollout (Telecommunication Sector). Read about it in this McKinsey Article

There are several ways to monitor your investments in the semiconductor sector. This includes benchmarks like the PHLX semiconductor Index and some Electronic Traded Funds.

Hardware

Hardwares are devices on which a software or a task is executed. Software firms have increasingly replicated task of different hardware equipment. However, hardware equipment is still required to interconnect network and internet. Hardware is used to execute the software instructions, such as life saving medical equipments, industrial sensors, consumer electronics etc. are prime examples of hardware equipments. Such equipments pay a vital role in the day to day functioning of human life.

Computer Network and Internet

A computer network is an interconnected computing device that exchanges data and shares resources. The creation of networks improved connectivity among businesses and consumers. Networking facilitated profound changes in commerce and spur up new business models like cloud computing, network security, and e-commerce.

Do you remember in 2024, a leading network monitoring firm caused a huge outage in the Information Technology (IT) industry? CrowdStrike’s integration into so many mission-critical operations and industries amplified the effect. In terms of network usage, do you see how interconnected and dependent businesses are? (Do not forget, these are a few risks of doing business in our current interconnected world). Did you find the CrowdStrike example? Learn more about it in this article.

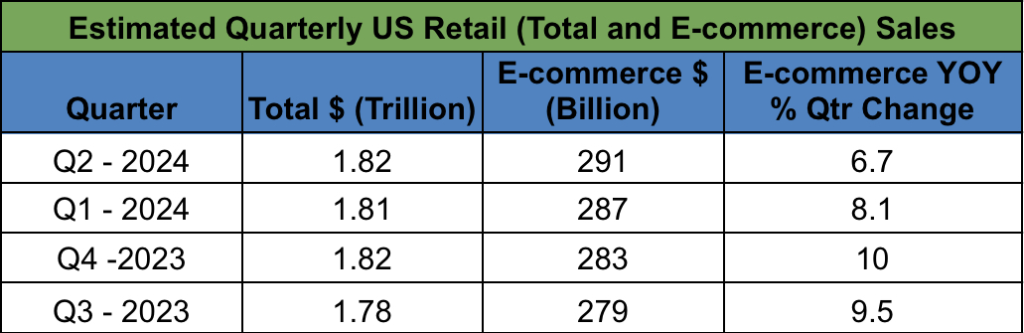

The US e-commerce market by 2024 is estimated to surpass $ 580 billion. Online sales are estimated to hit ~17% of 2024 retail purchases. Thus, network and facilitating businesses are behind the scenes that support these statistics. US census news.

What should an investor watch for when investing?

Risk is a significant part of the tech investment process, and diversification helps mitigate risk. Risks like high stock evaluation, expenditure, and obsolescence cycle can be difficult to comprehend at first.

Semiconductor investors should be mindful of one thing, it is highly cyclical. Semiconductor makers often see “boom and bust” cycles based on the underlying demand for chip-based products. When times are good, profit is high, when demand falls through, profit can fall dramatically.

Technology stocks regularly sport high valuations without free cash flow or profit. Some businesses undertake risky bets and invest heavily on research and development of new products. Conversely, carefully undertaken risky projects with robust product development efforts show future potential with a steady flow of income.

Technology expenditure and budget are first curtailed during an economic downturn. However, during recovery, the tech sector provides higher capital growth potential.

Obsolence cycle (OC): Leaders may not maintain their position for long and are ripe for disruption. OC paired with high sector competitiveness, makes it difficult for investors to gauge the tech sector correctly. While not every tech stock will fit into your personal style of investing, virtually every investor considers the sector for dynamism and growth.