Let’s talk about liquid investments first. Cash, Stocks, Bonds, ETFs, Mutual Funds.

1. Cash

Most liquid of any asset, provides a haven for most investors to start. Such investment gives a precise knowledge of the interest earned with a guarantee of the principal investment return. Savings accounts in many banks provide a safe investment strategy. Keep in mind that cash in savings accounts does not beat inflation rates. On the other hand certificates of deposit are less liquid cash assets that provide higher interest rates than savings accounts, but come with a lockup period with early withdrawal penalties.

We consolidated a few savings account interest rates broadly offered by different banks. Consider these for educational purposes and not investment advice. Please check these rates before making any decisions.

These four institutions provide high savings account interest rates during during publishing. The way we compile data is based on research via Bankrate. You can look at more such information here and get an updated list. Also, these rates can change according to these institution and no such guarantee is provided by FinFitForte on rates or institution in general. Please do your own research carefully before you use any of these services. The list below is for educational purpose.

- Western Alliance Bank: APY 5.31%, No minimum balance.

- ForBright Bank: APY 5.30%, No minimum balance.

- Jenius Bank: APY: 5.25%, No minimum balance.

- BMO Alto: APY 5.10%, No minimum balance

2. Bonds

An investment product that lets an individual lend money to corporations and governments at a fixed interest rate. The money lent is used to finance projects and corporate operations.

- Bonds are a fixed-income investment. You receive a fixed income based on bond rates after the bond maturity.

- Federal interest rates are inversely related to bond prices. (We know this is perplexing information and we will post new material explaining this information)

- The best time to invest in bonds is when federal reserves have set interest rates high. This will provide investors with maximum returns from the investments when the rates are eventually eased.

3. Mutual Funds

Combining money from various investors to buy a variety of asset classes (Bonds, Stocks, Commodities). Some pros to mutual fund investments; are diversification, lower transaction costs for mutual funds, option for professional management, and transparency. Where there are pros there are cons too; there is no FDIC guarantee, high cash drag (Cash in hand to meet investor liquidity demand causes deprecation by inflation and fees), high honorarium, and incurred taxes.

4. Stocks

A share is the ownership of a company. Companies that let investors participate in its success via increased share prices or dividends (A sum of money paid by the company regularly to its investors). Keep in mind that stocks carry high risk. Investors can lose their entire investment due to sector/industry-wide risks.

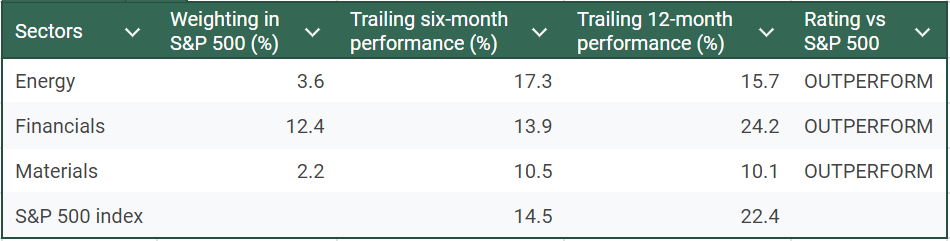

Three sectors are suppose to outperform the market in 2024 according to Charles Schwab research here. Choose a stock which meets your needs and goals accordingly.

5. Electronic Traded Funds (ETF)

ETFs are extremely popular with investors due to ease of trade and exposure to multiple assets. A few versatile and effective ways to get exposure to numerous assets. ETFs can track certain index funds, stocks in emerging markets, commodities, or individual sectors (ex: healthcare, biotechnology, etc.)